Attribution is simply how you credit marketing touchpoints for a conversion. Pick the wrong lens and you’ll either overfund noisy channels or starve the ones that set deals up. Below is a practical guide that contrasts e-commerce and SaaS, explains the main models, and shows when to use which—plus how to sanity-check the results.

Why attribution is hard (and different) for e-commerce vs SaaS

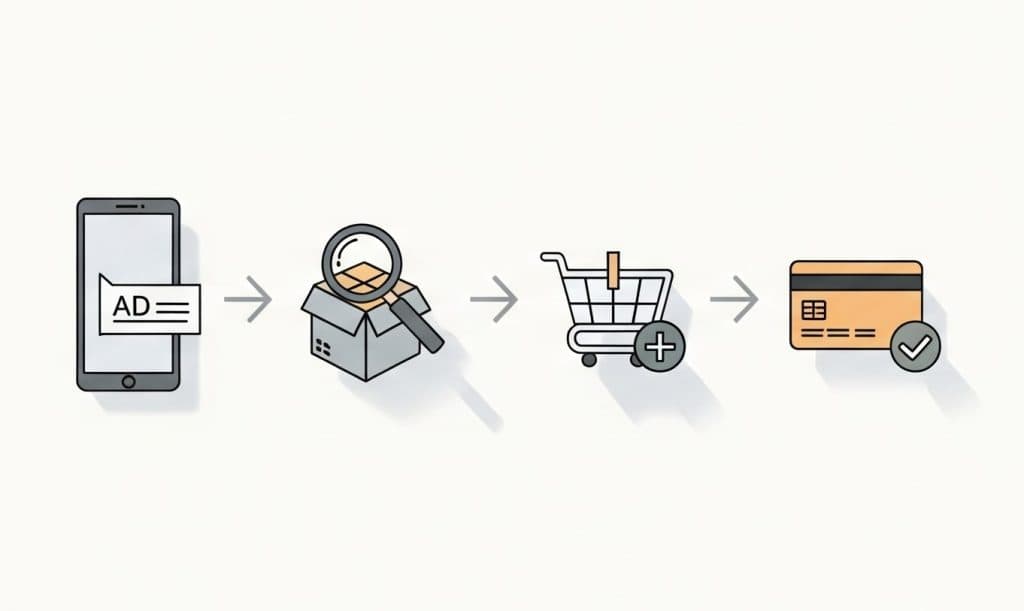

E-commerce

- Short(er) path to purchase; many low-ticket decisions.

- Heavy retargeting and promotions; lots of last-click activity.

- Conversions are online and immediate (add-to-cart → checkout).

- North-star: ROAS, MER, contribution margin per order.

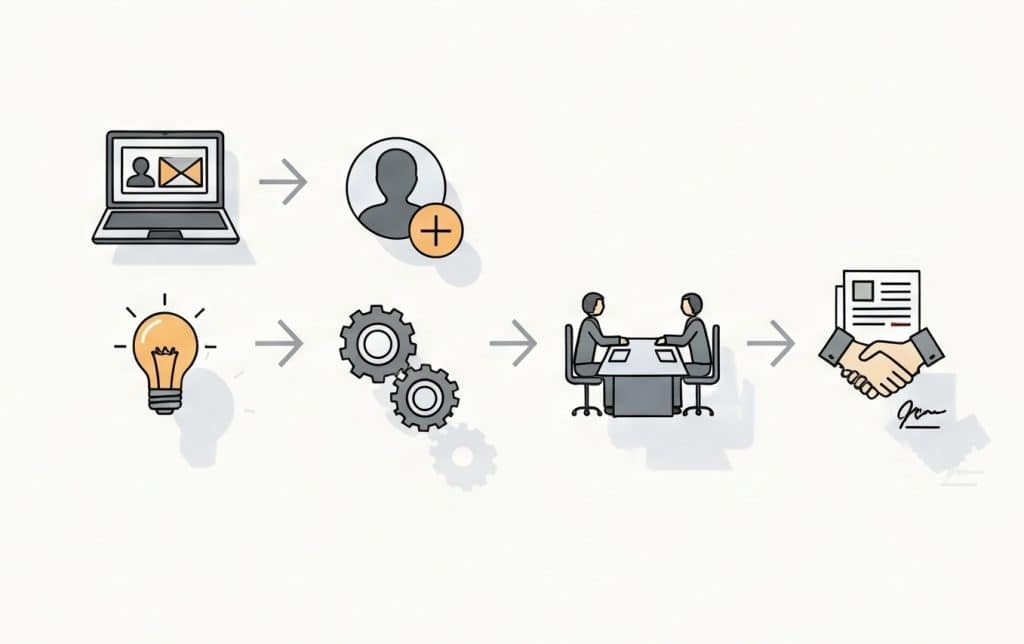

SaaS

- Long, multi-stakeholder journeys (ad → content → signup → PQL → demo → contract).

- Multiple funnel goals (signup, activation, opportunity, closed-won).

- Offline touches (SDR emails/calls, events) matter.

- North-star: CAC payback, LTV:CAC, pipeline velocity.

The attribution toolbox (rule-based to experimental)

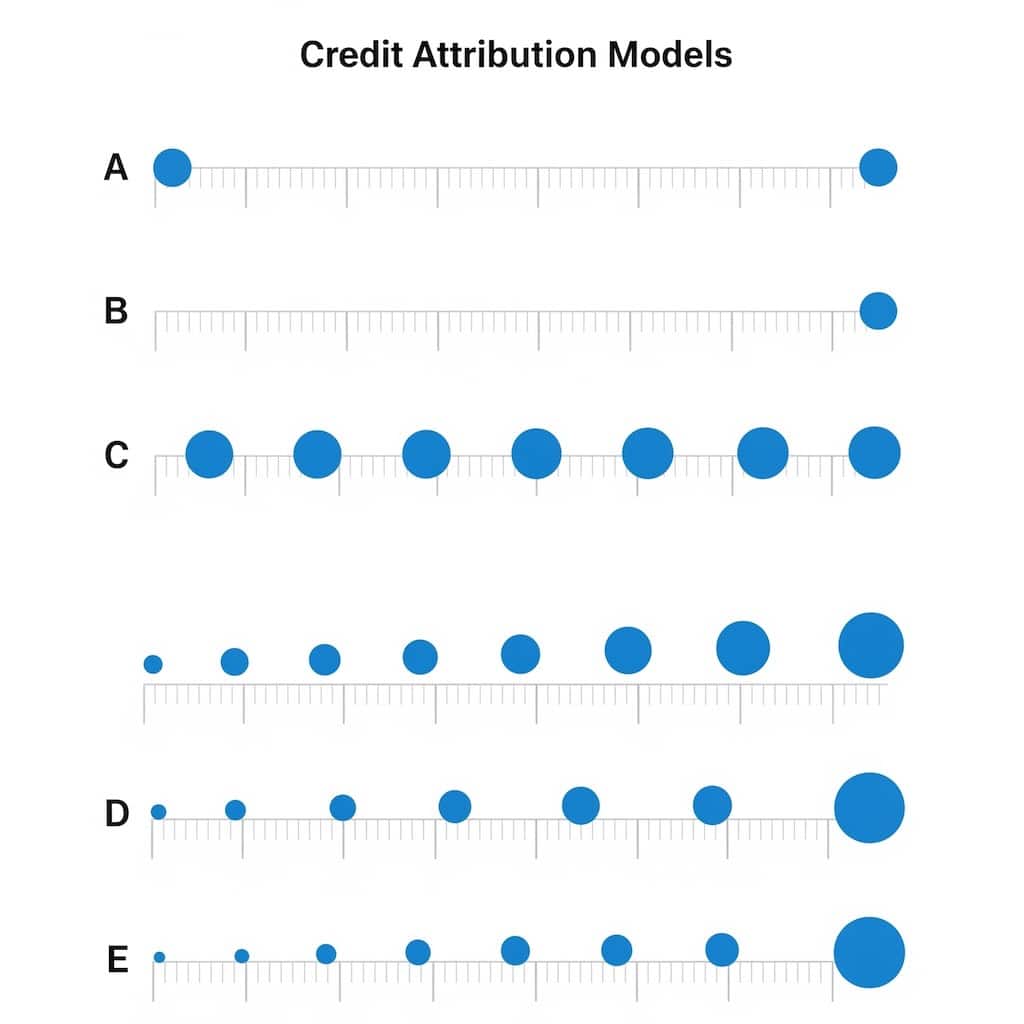

Single-touch

- Last click: 100% credit to final touch.

- First click: 100% credit to first touch.

Multi-touch (rule-based)

- Linear: equal credit to all touches.

- Time decay: more credit as touches get closer to conversion.

- Position-based (U-shaped): heavier on first & last; some for the middle.

- W-shaped / Z-shaped: adds weight to opportunity-creating touches (e.g., first touch, lead creation, opportunity).

Data-driven (algorithmic MTA)

- Learns marginal contribution of each touchpoint from your data.

Beyond click-paths

- Incrementality tests (geo-lift, PSA tests, holdouts): measure lift rather than credit.

- MMM (Marketing Mix Modeling): statistical model using spend & outcomes over time; great for channel-level budget setting.

Pro tip: Use MTA for tactics and MMM/incrementality for budgets. Triangulate—don’t bet the farm on one lens.

Quick recommendations by business type

If you’re E-commerce

Early stage / sparse data

- Use Last non-direct click as a sanity baseline for paid search & shopping.

- Layer Time decay to reduce over-crediting low-funnel retargeting when there’s more than one touch.

Scaling / multi-channel

- Adopt Position-based (U-shaped) for most prospecting → retargeting paths.

- Keep Last click alongside it for reporting continuity; compare ROAS deltas.

- Add Data-driven once you have volume (tens of thousands of conversions) across channels.

Promotion-heavy or catalog-wide campaigns

- Run geo-holdouts on paid social & display to capture view-through impact without over-attributing.

- Pair with a lightweight MMM to set split between search, social, affiliates.

What to watch

- Contribution margin per order (post-promo, post-shipping).

- New vs returning customer mix (attribution should not push you into discounting your base too hard).

If you’re SaaS

Top-funnel + PLG motion

- Use W-shaped (first touch, lead creation, opportunity) to reward content & community that create pipeline, not just signups.

- Track multiple conversions: Signup → Activation (PQL) → SQL → Closed-won.

Sales-assisted / Enterprise

- Combine W- or Z-shaped with manual touches from CRM (SDR sequences, events).

- Implement Data-driven once events are properly stamped (UTMs, email touches, meetings).

- Validate with incrementality (e.g., turn off LinkedIn in select regions for 4 weeks).

What to watch

- LTV:CAC and payback by channel & segment.

- Pipeline source vs influence: a channel can influence deals without sourcing them—don’t cut it blindly.

Choosing a model: a practical decision matrix

| Situation | E-commerce pick | SaaS pick |

|---|---|---|

| Few touches, fast checkout | Last non-direct click → Time decay | Position-based if content assists; else First click for demand gen visibility |

| Many touches across weeks | U-shaped or Data-driven + promo holdouts | W-/Z-shaped or Data-driven + SDR/CRM events |

| Heavy brand spend | MMM + geo-lift for brand; MTA for lower-funnel | MMM/geo-lift for brand & events; MTA for mid/low funnel |

| Need board-level budget split | MMM (quarterly) | MMM (quarterly) |

| Need channel/creative optimization | MTA (rule-based → data-driven) | MTA (W-shaped → data-driven) |

Implementation checklist (works for both)

- Define conversion chain

E-com: View content → Add to cart → Purchase.

SaaS: Visit → Signup → Activation → MQL/SQL → Opportunity → Closed-won. - Event hygiene

- Standardize UTMs; enrich with campaign, creative, audience.

- Stamp offline touches (CRM campaign members, calls, meetings, events).

- Identity resolution

- Stitch by user_id, email (hashed), and device cookies where legal.

- Capture first-party identifiers at signup/checkout.

- Pick a baseline and an experiment

- Baseline: rule-based model everyone can see.

- Experiment: data-driven or holdout to calibrate.

- Governance & reviews

- Re-evaluate weights quarterly.

- Freeze models during big promos or pricing changes to avoid noisy flips.

Common pitfalls (and fixes)

- Over-crediting retargeting

Symptom: Amazing ROAS, flat new buyer growth.

Fix: Add Time decay or cap frequency; segment new vs returning. - Ignoring post-signup stages in SaaS

Symptom: Channels look great at signup, poor at revenue.

Fix: Attribute to opportunity and revenue, not just signups; use W-shaped. - View-through bias

Symptom: Display/social look heroic.

Fix: Use geo-lift or PSA tests; limit view-through windows. - Model hopping

Symptom: Weekly changes, confused teams.

Fix: Publish a measurement charter: which model for what decision, and when it’s reviewed.

Mini case studies

E-commerce apparel brand (mid-market)

Switched from Last click to U-shaped. Prospecting on TikTok looked “bad” on last click but “good” on U-shaped. A 10% budget shift from retargeting to prospecting increased new customers +18% at similar MER. Geo-holdouts confirmed +7–10% incremental sales in treated regions.

SaaS workflow tool (ACV ~$25k)

Implemented W-shaped with CRM touches. Content syndication was under-credited on last click but drove +22% more opportunities than reported. LinkedIn audiences looked inflated until a 6-week geo test showed +9% incremental pipeline; budgets were kept, but creatives were pruned.

How to report it so people trust it

- Always show two views: your baseline (e.g., Last click) and your chosen model (e.g., W-shaped). Explain the gap.

- Tie to business outcomes: CAC payback (SaaS) and contribution margin (e-com).

- Summarize with 3 bullets and a budget recommendation, not just a chart.

Key takeaways

- E-commerce: Start with Last non-direct → upgrade to U-shaped or Data-driven; validate with geo-holdouts and watch contribution margin.

- SaaS: Favor W-/Z-shaped (multi-stage) and integrate CRM touches; validate with incrementality and optimize to revenue, not signups.

- Everyone: Use MTA for optimization, MMM/incrementality for budgets, and revisit models quarterly.

Starter templates

Attribution charter (one-pager)

- Decisions covered: budgeting, channel pruning, creative testing

- Models used: MMM for budgets, W-shaped for SaaS / U-shaped for e-com

- Review cadence: Quarterly

- Source of truth for revenue: CRM/ERP

- Change log: link

UTM standard

utm_source,utm_medium,utm_campaign,utm_content(creative id),utm_term(keyword/audience)- Enforce via link builders and CI checks in ad ops.

Leave a Reply