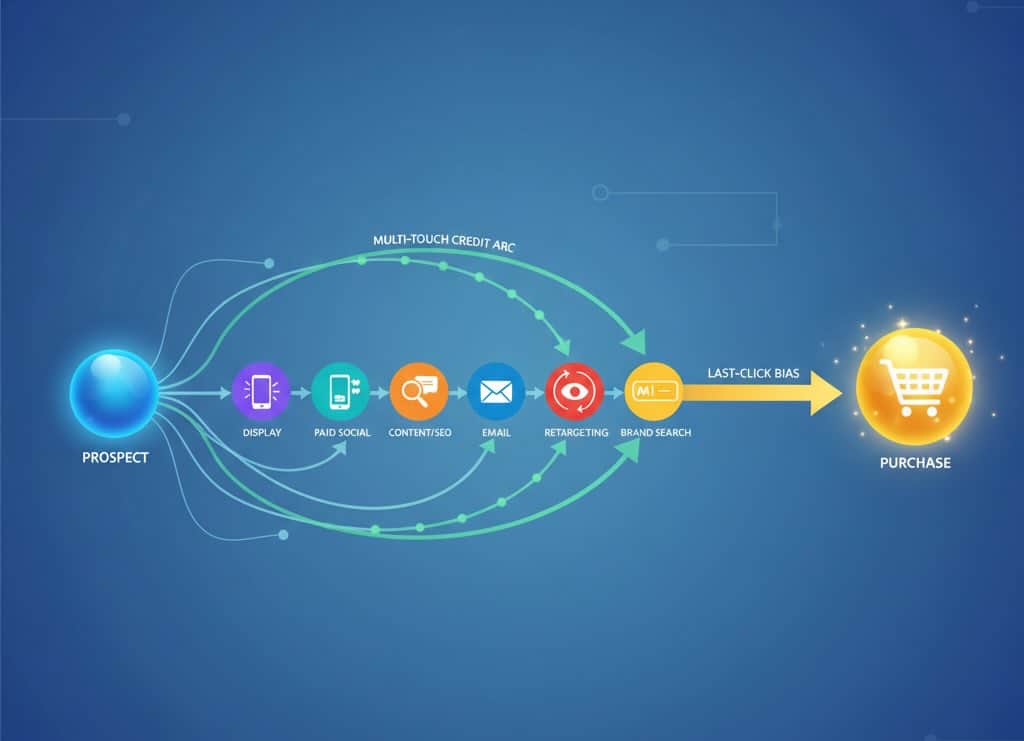

Last-click is simple—and simply wrong for modern funnels. It credits the final touch (often brand search or direct) and under-values upper- and mid-funnel work that actually created demand. If you’re allocating budget on last-click alone, you’re almost certainly over-investing in harvest channels and starving the ones that plant and nurture. Here’s a pragmatic playbook to move beyond last-click and fund channels according to their real contribution.

Why last-click fails (and what “good” looks like)

Symptoms of last-click bias

- Brand search looks like a superhuman performer.

- Prospecting display/social appear unprofitable.

- Retargeting is over-funded because it harvests demand created elsewhere.

- Content/SEO gets under-credited for first-touch and mid-funnel assists.

A better goal

Attribute value across all meaningful touches, estimate incremental impact, and use those insights to reallocate spend toward the highest marginal return.

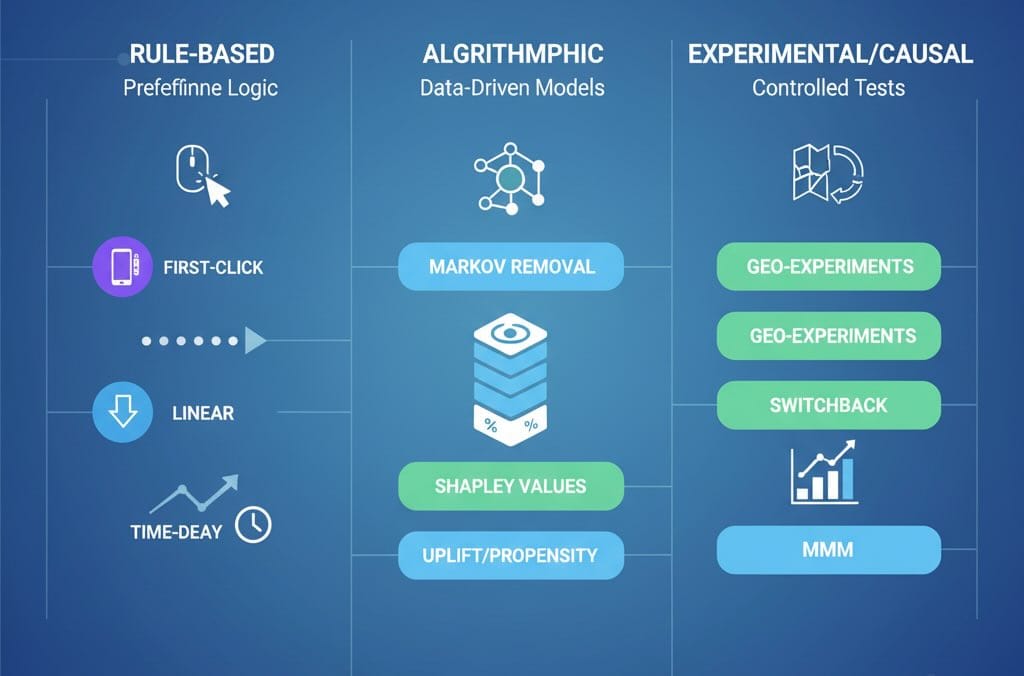

The attribution toolbox (rule-based, algorithmic, experimental)

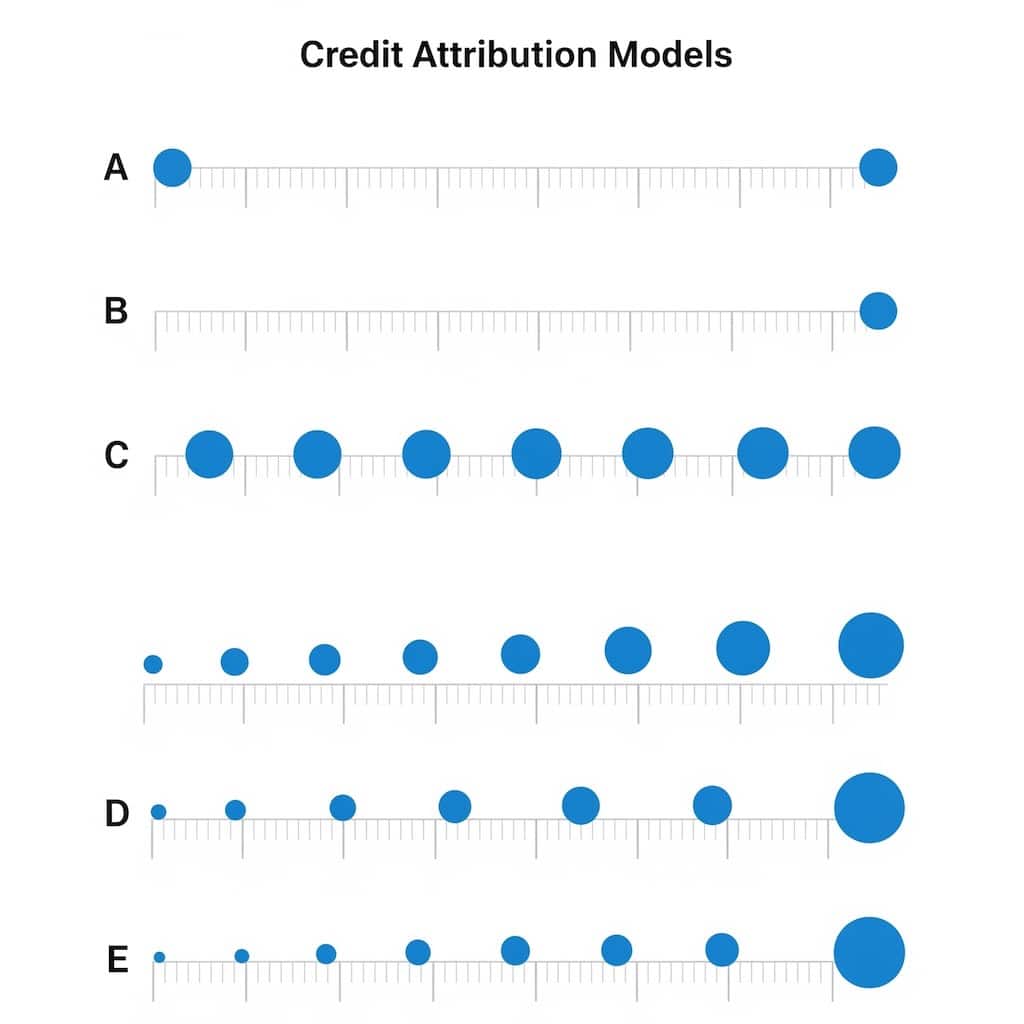

1) Rule-based models (fast, directional)

| Model | When it helps | Watch-outs |

|---|---|---|

| First-click | Value discovery/awareness | Over-credits prospecting; ignore conversion closers |

| Linear | Simple “team sport” view | Treats all touches as equal (they’re not) |

| Time-decay | Long cycles where recency matters | Still arbitrary weights |

| Position-based (U-shape/W-shape) | Credit intro + nurture + close | Pre-set weights; tune by journey length |

Use case: Establish a baseline and sanity-check extremes (“Are we over-funding retargeting?”). Rule-based is easy to deploy in GA4/BI and useful as an operator view, not the exec truth.

2) Algorithmic models (data-driven, diagnostic)

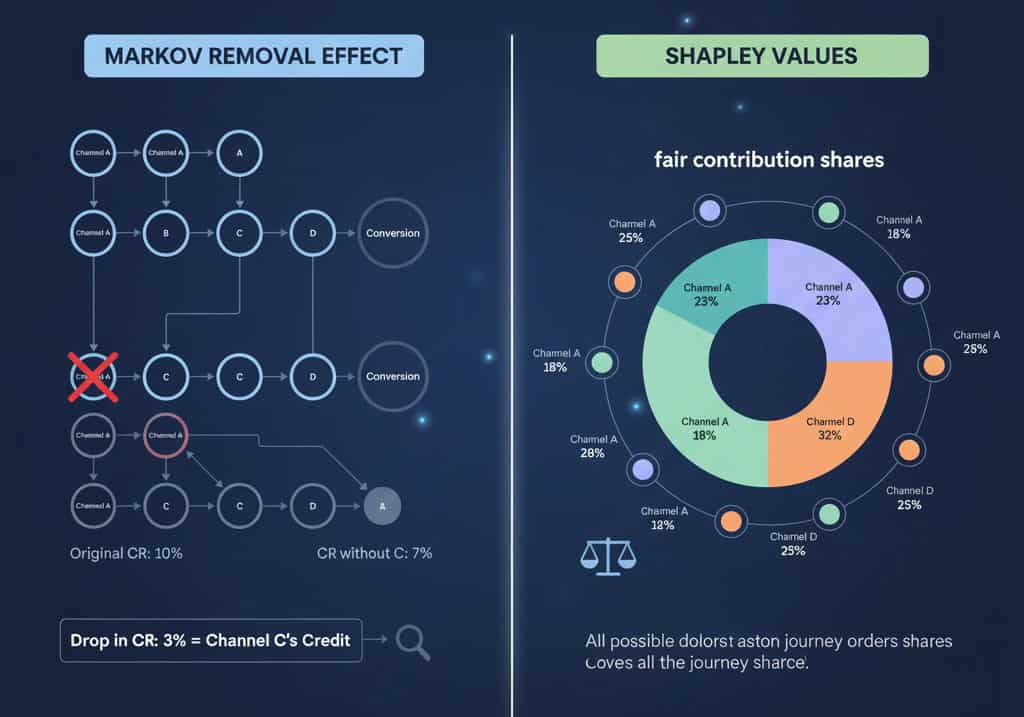

- Markov chains (removal effect): Simulate journeys; remove a channel and measure conversion rate drop. Great to surface true assist value (e.g., upper-funnel display that “opens” paths).

- Shapley values: Game-theory credit based on all channel permutations. Fair but computationally heavier.

- Uplift/propensity models: Predict the incremental probability of converting because of exposure. Powerful in walled gardens or for targeting strategy.

Use case: Diagnose which channels (and sequences) create value vs. ride along. Requires clean path data, consistent channel taxonomy, and enough volume.

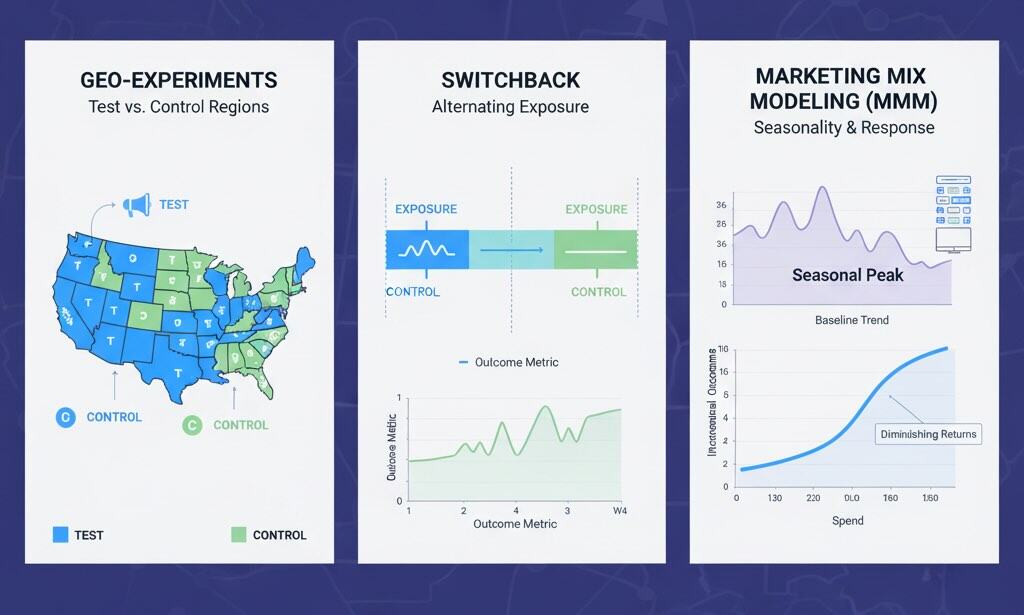

3) Experimental & causal reads (gold standard for budget)

- Geo-experiments / PSA holdouts: Turn spend up/down in test geos; compare to controls.

- Staggered rollouts / switchback tests: Alternate exposure by time or audience.

- MMM (Media Mix Modeling): Top-down, long-horizon model for incremental contribution by channel with seasonality and price effects.

Use case: Set budget at the portfolio level and validate model-based attribution. Ideally, run at least one causal read per quarter.

Data foundations that make or break MTA

- Identity stitching:

Use a hierarchy:user_id(logged-in) → first-party identifiers (hashed email/phone) → device + modeled links. Respect privacy and consent (CMP, opt-out flows). - Unified channel taxonomy:

Normalize source/medium/campaign and dedupe platforms’ self-reported conversions (especially post-view). - Consistent windows & conversion definitions:

Align lookback windows per channel (e.g., 7-day click for paid social, 30-day for search) and lock definitions so finance can reconcile. - Event quality:

Track micro-conversions (product view, add-to-cart, demo start) and macro-conversions (orders, SQOs, revenue). Send channel & landing metadata into CRM/orders. - Privacy resilience:

With fewer third-party cookies, lean on first-party data, modeled conversion APIs, and consented server-side tracking.

E-commerce vs. SaaS: model choices that fit the motion

E-commerce (many touches, short cycles, large SKU mix)

- Primary: Markov or Position-based with SKU/margin overlays. Optimize to revenue per visit and contribution margin, not just ROAS.

- Causal guardrail: Geo-lift when scaling new channels or creative types.

- Tactics:

- Separate brand vs. non-brand search.

- Break out retargeting to prevent over-credit.

- Attribute content/SEO assists via time-decay or Markov.

B2B/SaaS (long cycles, offline stages, lower volume)

- Primary: Position-based (W-shape: first touch, lead creation, opportunity) across people and accounts; add Shapley for diagnostic fairness.

- Causal guardrail: Holdouts on paid social or ABM audiences; MMM annually for board budgets.

- Tactics:

- Attribute to opportunity creation and pipeline value, not just MQLs.

- Map multi-person journeys at the account level (buyer committees).

- Use time-decay for nurture touches over long sales cycles.

Turning attribution into budget moves

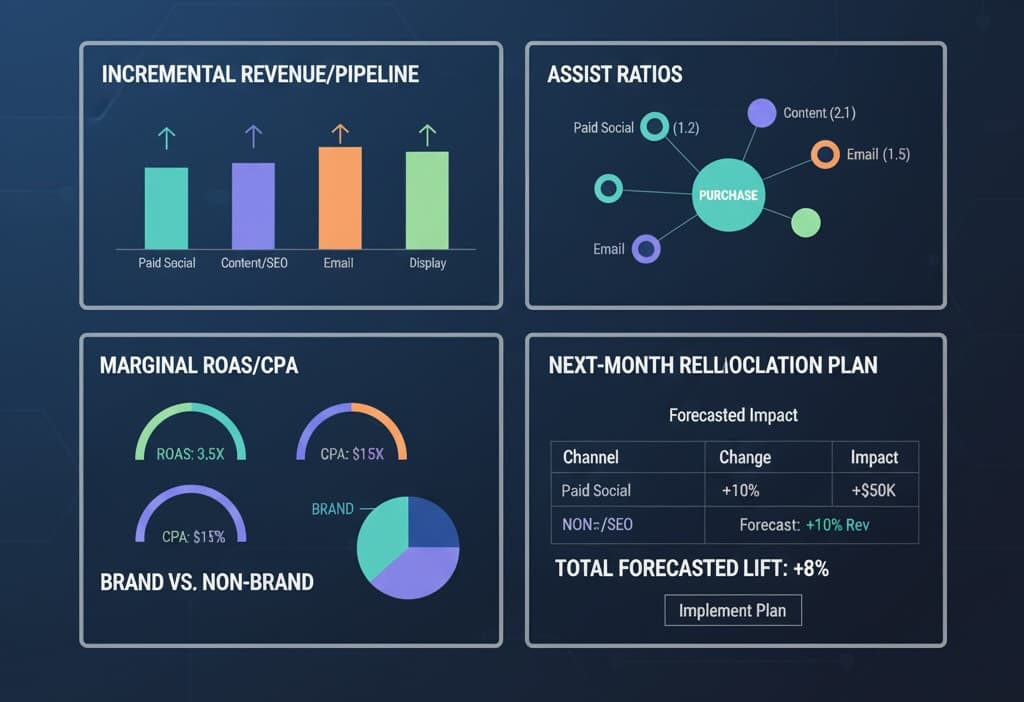

- Build a scorecard execs will trust

- Top channels by incremental revenue/pipeline and marginal ROAS/CPA

- Assist ratios (assists:conversions) to surface under-valued channels

- Non-brand vs. brand split

- Next-month reallocation plan with forecasted impact

- Optimize to the margin, not just revenue

- Apply product/category margins so you don’t over-fund low-margin winners.

- Track incremental cost per incremental order/opportunity (ICPO/ICPOp).

- Use marginal analysis

- For each channel, estimate the next $10k effect (from geo-tests/MMM response curves).

- Shift spend from low-marginal-return to high-marginal-return buckets weekly.

- Create “funding rules”

- If channel’s marginal ROAS > target → greenlight scale to the next cap.

- If assist share is high but last-click is low → protect with a floor budget; judge on assisted conversions and Markov removal effect.

Common pitfalls (and how to avoid them)

- Platform double counting:

Use a system of record for conversions (analytics or orders/CRM). Treat platform-reported numbers as directional. - Attribution ≠ incrementality:

Run periodic causal tests. Calibrate models to those results. - One model to rule them all:

Keep one primary model for exec reporting and one diagnostic to guide channel owners. Consistency beats model-hopping. - Ignoring creative & audience granularity:

Attribution at the channel level hides variance. Evaluate audience × creative cells for true scale pockets. - Privacy whiplash:

Expect fewer deterministic links. Invest in first-party data, modeled conversions, and consent management.

What “good” looks like (signs you’re winning)

- Budget moves weekly based on marginal returns, not politics.

- Prospecting and mid-funnel content get protected budgets because assist value is proven.

- Brand search ROAS normalizes after removing misattributed credit.

- Leadership dashboards show incremental revenue/pipeline with error bars from experiments—not just pretty charts.

Bottom line: Last-click is a flashlight—it shows you the finish line and hides the race. Multi-channel attribution blends rule-based clarity, algorithmic nuance, and experimental truth so you can fund the touches that create demand, not just the ones that collect it. Shift budgets with confidence, and your CAC and payback will tell you you’re on the right track.